Slow down.

That was the message for the Trudeau government at a meeting in Lunenburg last night.

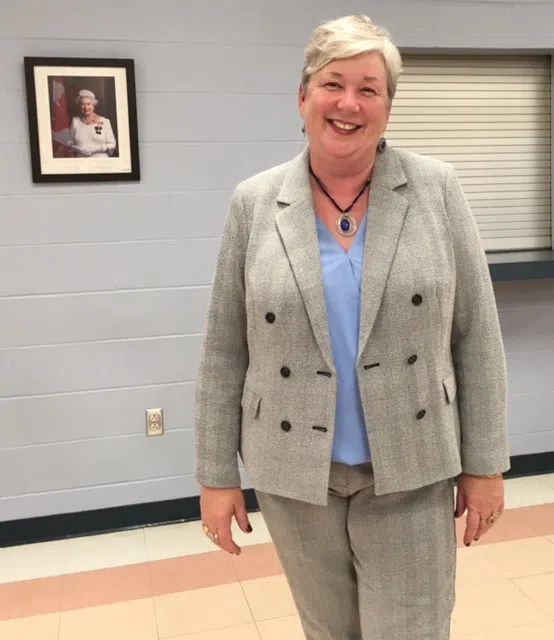

Over two hundred people packed the fire hall to have South Shore- St. Margaret’s MP Bernadette Jordan hear their concerns around the proposed changes to income tax rules on incorporated businesses.

Full house in Lunenburg to hear @BernJordanMP on proposed changes to income tax pic.twitter.com/E7KzcO0fbZ

— Ed Halverson (@edwardhalverson) September 12, 2017

The regulations would impact how business owners pay their salary, their employees and plan for retirement.

Jordan says she listened closely last night and doesn’t think this is the final word on the tax reform.

“Even though people are concerned because, ‘Oh, this is already written.’ I think it’s a work in progress. I think it’s a white paper than can easily be changed, or not, depending on what we hear from people across the country.”

Jordan says she is listening to everyone’s concerns but also has to consider the people who can’t access the same tax benefits.

“I actually had an e-mail from someone that said that he has enjoyed those benefits of being an incorporated business for a number of years and always wondered why.”

Jordan says she will take what she heard back to Ottawa to share with the finance minister.

Paul McNeil is an accountant and partner at Belliveau Veinotte, and he says Canadians have not been given enough notice to properly plan for the proposed changes.

He is concerned how the new rules will impact those who can least afford it.

“If you take, for example, somebody who makes $60,000 and let’s just say, arbitrarily that the hit is a 10% hit. In my opinion, the person who’s paying $6,000 who only makes $60,000 is going to feel it a lot more than the person who is making $250,000 who has to pay $25,000 more.”

MacNeil feels government is painting a poor picture of small business owners.

“These structures were designed intentionally to help small business, to foster small business. For the government to take an approach of pitting one group of people against the other is very un-Canadian in my opinion.”

McNeil doesn’t think government has allowed enough time to learn the impact these changes will have on business owners.

He wants the finance department to hit pause on the process until a full analysis can take place.